Roth ira conversion calculator vanguard

A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. Select Balances holdings under the My Accounts dropdown in the main navigation.

The Bold And Beautiful Roth Conversion Ladder Clipping Chains

Converting to a Roth IRA may ultimately help you save money on income taxes.

. How to Convert a Traditional IRA to a Roth IRA at Vanguard. Use the tool to compare estimated taxes when you do. Claim 10000 or More in Free Silver.

Only investors filing under a certain income limit qualify for Roth IRA contributionsbut the two-step backdoor Roth conversion strategy is open to investors at all. Institutional investors For retirement plan sponsors consultants and nonprofit. In other words you.

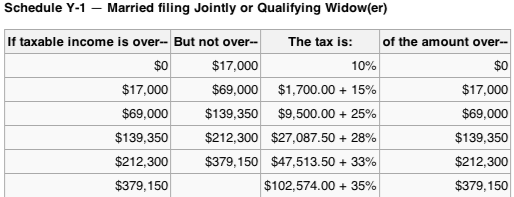

Vanguard Roth IRA Conversion Calculator. For people who invest through their employer in a Vanguard 401k 403b or other retirement plan. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA.

Ad If you have a 500000 portfolio download 13 Retirement Investment Blunders to Avoid. 2022 Roth Conversion Calculator This calculator can help you make informed decisions about performing a Roth conversion in 2022. Visit the Balances and Holdings Page in Your Vanguard Account.

Breaking down the differences between traditional and Roth. Your IRA could decrease 2138 with a Roth. So thinking youre not about to retire next year you desire development and also concentrated investments for your Roth IRA.

Its Our Ownership Structure That Sets Us Apart From The Competition. Here is how to do it at Vanguard. Withdrawals taken prior to age 59½ or five years may be subject.

You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will. Ad Top Rated Gold Co.

Calculator Ira To Roth Conversion Vanguard A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. Converted plan balance is allowed to grow tax-free and all withdrawals are tax-free as well. Roth IRA Conversion Calculator Vanguard.

Roth IRA is a great way for clients to create tax-free income from their retirement assets. IRAs are a great tax-advantaged way to save for retirement. Download 13 Retirement Investment Blunders to Avoid from Fisher Investments.

Roth Ira Conversion Calculator Vanguard A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. Your retirement is on the horizon but how far away. Protect your retirement with Goldco.

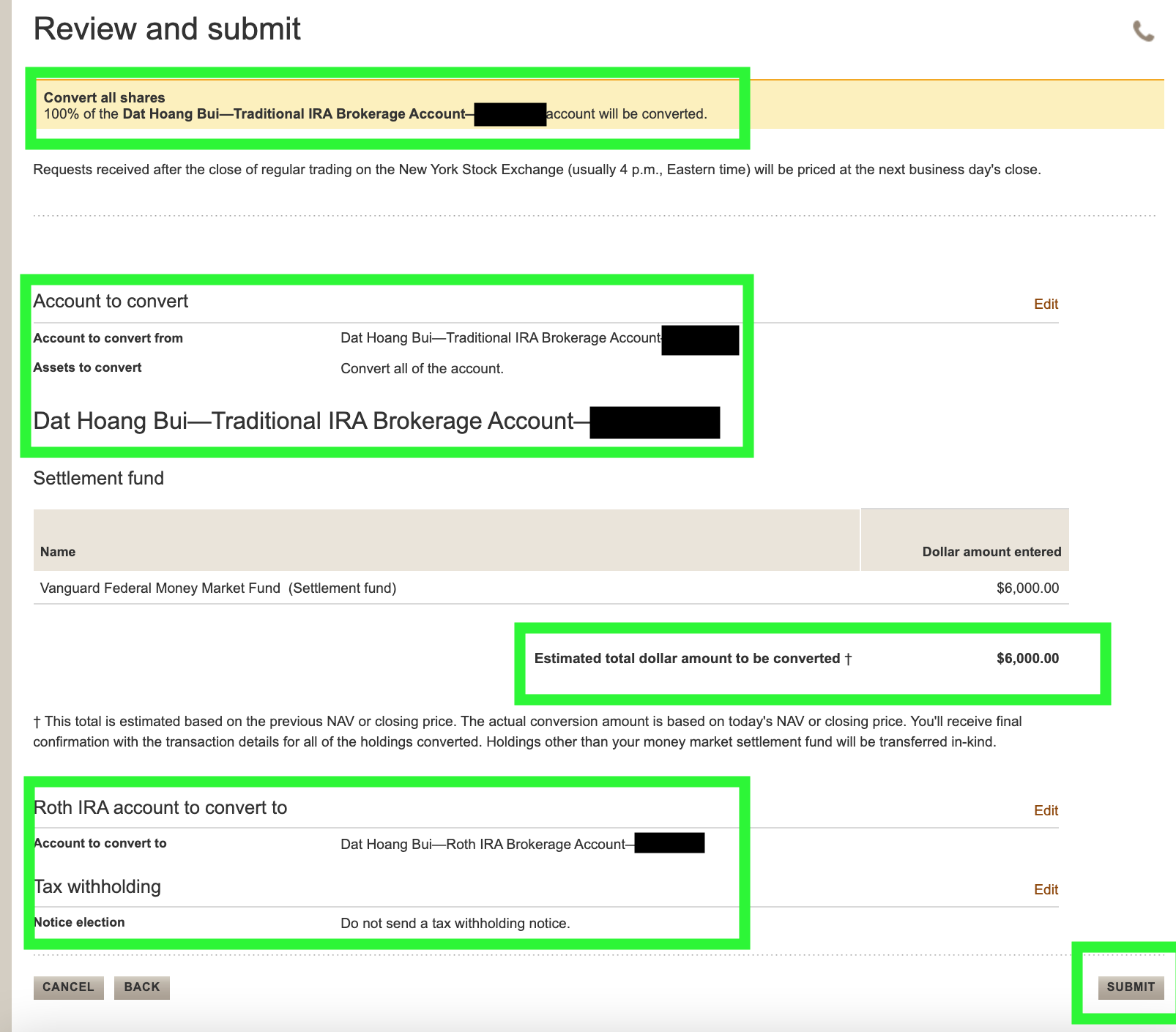

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional. Presuming youre not about to retire following year you want development as well as focused investments for your Roth IRA. Convert investments from your traditional IRA brokerage account If you hold ETFs exchange-traded funds individual stocks and bonds or other investments in a Vanguard traditional IRA.

There are 2 types of IRAstraditional and Rothand. Withdrawals from a Roth IRA are generally tax free if you are over age 59½ and have held the account for at least five years. Ad Discover Why Vanguard Emphasizes The Value Of Ownership.

By thousands of Americans. Once converted Roth IRA plans are not subject to required minimum distributions RMD. Roth IRA rules dictate that as long as youve owned your account for 5 years and.

For instance if you expect your income level to be lower in a particular year but increase again in later years. Request Your Free 2022 Gold IRA Kit. Step 2 On the Balances holdings page find the Traditional IRA you want to convert then select the.

The Optometrist S Guide To Roth Ira Chapter 2 Step By Step Vanguard Ods On Finance

Roth Ira Conversion How To Convert Without Losing Money Or Paying Taxes

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Should I Convert My Dividend Growth Ira To A Roth Ira Seeking Alpha

How I M Using A Roth Ira Conversion Ladder To Access Retirement Funds Early A Step By Step Guide A Purple Life

Roth Conversions Could Offer More Value Than Your Clients Expect

A Betr Calculation For The Roth Conversion Equation Vanguard

A Betr Calculation For The Roth Conversion Equation Vanguard

Roth Ira Conversion Is It Right For You And Rules To Know Nextadvisor With Time

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

The Global Payment Solution For Cryptocurrency That Is Simple Powerful And Painless To Integrate Machine Learning Models Cryptocurrency Samsung Pay

How To Convert A Traditional Ira To A Roth Ira Vanguard

How To Convert A Roth Ira At Vanguard An Illustrated Tutorial

The Optometrist S Guide To Roth Ira Chapter 2 Step By Step Vanguard Ods On Finance

Roth Ira Conversion How To Convert Without Losing Money Or Paying Taxes

How A Roth Conversion Ladder Works Withdraw Penalty Free In Early Retirement Youtube

When Should You Consider A Roth Conversion Vanguard Has An Answer