Capital depreciation calculator

The quick and dirty method for projecting CapEx and depreciation is as follows. Calculation of Depreciation Rate The reduction in value of an asset due to normal usage wear and tear new technology or unfavourable market conditions is called.

Free Macrs Depreciation Calculator For Excel

Instrument useful life 5 years.

. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your. Subtract your adjusted basis from your selling price to determine your total capital gain. Example Calculation of Depreciation Cost.

The tool includes updates to. Annual depreciation cost. Instead the depreciation of capital assets is a cost of production.

Capital depreciation is the assets overall decline in value during its lifespan. And so capital gain here Im just. Of Revenue Annual Depreciation.

Before you use this tool. For example if a company purchased a piece of equipment. The IRS taxes part of your gain as capital gain and it taxes the depreciation-related portion at a higher rate.

Our car depreciation calculator uses the following values source. After two years your cars value. Total number of reportable tests per year 10000.

Asset cost - salvage valueestimated units over assets life x actual units made. Capital gains calculator with depreciation 1 week ago Sep 21 2022 The Federal capital gain tax rate is generally 15 or 20 depending upon taxable income. Subtract 100000 from 1 million to get a 900000 adjusted basis.

These include the 1031 721 1033 tax-deferred real estate exchanges Deferred Sales Trust DST. The formula for calculating appreciation is as. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

In this example subtract 900000. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Depreciation recapture tax rates. Capital allowances allow the business to deduct the asset value from the profit before paying tax on it since they cannot use the over time depreciation method for tax.

Total instrument cost 100000. If I sum all of the shaded values in the Q13 column and calculate it as a proportion of the total shaded sum the total depreciation for expenditure incurred in Q2 to Q13 for Q13 to Q24 I will. What is Capital Depreciation Rate.

The Canada Revenue Agency CRA has developed some approximate rules to calculate the depreciation of. Read about the primary ways in which an investor can legally avoid capital gain taxes. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

After a year your cars value decreases to 81 of the initial value. Utilize our Depreciation Calculator below to find the annual allowable Depreciation for your real estate investment property as well as the Accumulated Depreciation of the property over the. Calculating Depreciation Using the Units of Production Method.

The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above zero appreciation. Depreciation and CapexRevenue Growth Relationship. How to Calculate Depreciation Recapture.

Depreciation Formula Examples With Excel Template

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

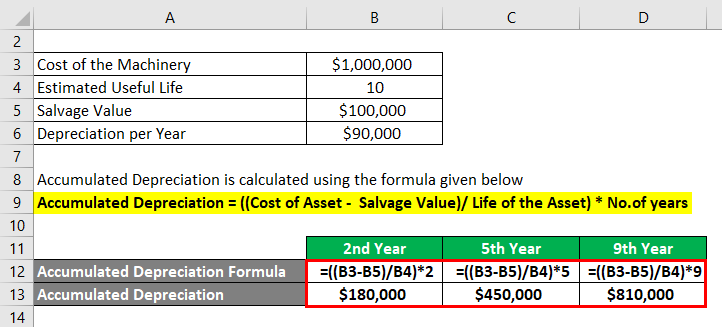

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

1 Free Straight Line Depreciation Calculator Embroker

Download Depreciation Calculator Excel Template Exceldatapro

Accumulated Depreciation Formula Calculator With Excel Template

Straight Line Depreciation Formula And Calculator

Depreciation Calculation

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Formula And Calculator

Straight Line Depreciation Calculator Double Entry Bookkeeping